[slideshow_deploy id=’899′]

BY MICHAEL OLOHAN

OF NORTHERN VALLEY PRESS

TRENTON, N.J.—As wrangling continues over a bill to legalize recreational marijuana in New Jersey, which proponents say could generate $80 million to $100 million in annual revenues, the New Jersey State League of Municipalities is warning mayors that time is of the essence to protect their towns against costs—and to reach for their slice of the pie.

Meanwhile, many Pascack Valley and Northern Valley municipalities have come out strongly against legalization and local sales.

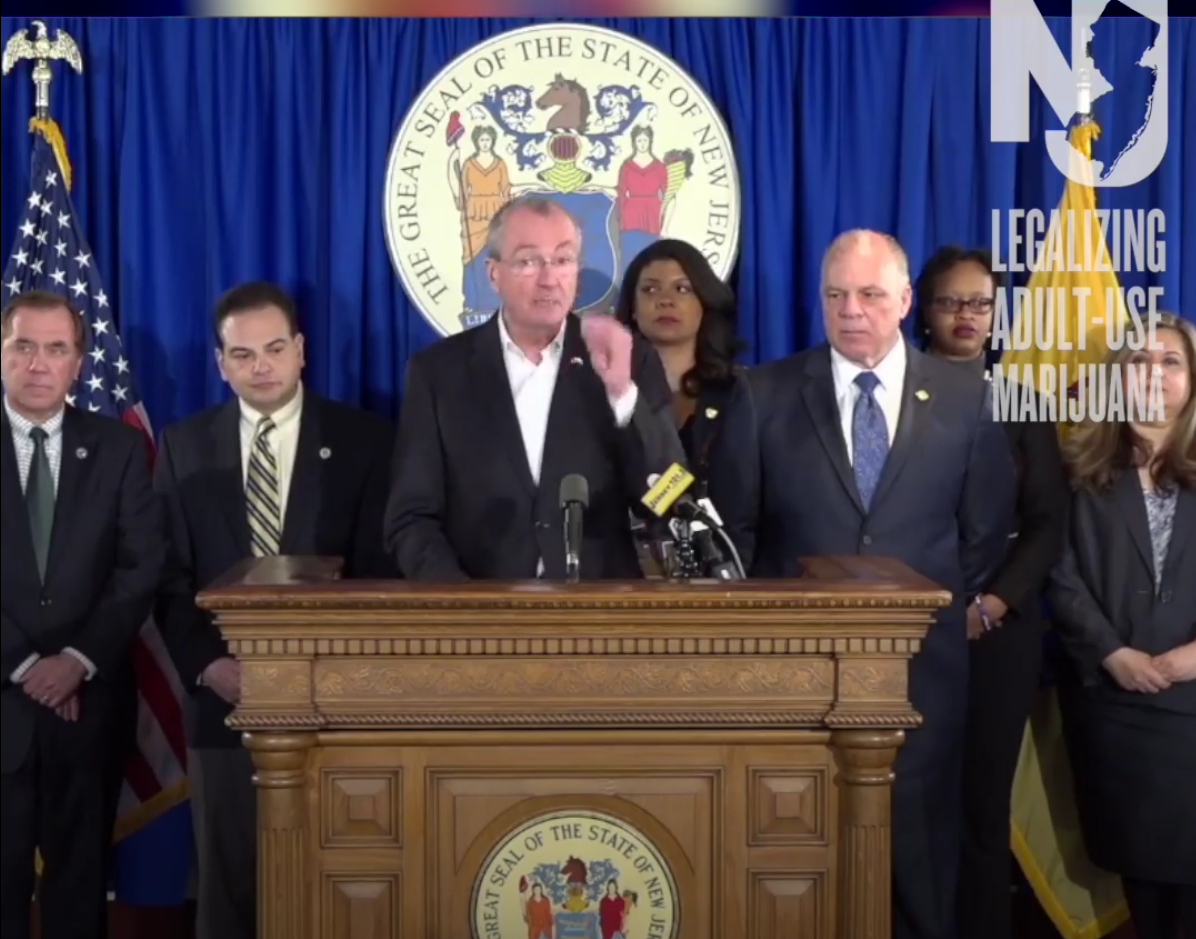

A marijuana legalization bill is expected to be introduced this year, and in fact was a campaign pledge of Democratic Gov. Phil Murphy.

But without more tax revenues going to local governments, the league contends municipalities will bear increasing costs from marijuana legalization while the state reaps maximum tax revenues.

The organization, a voluntary association created by a New Jersey statute in 1915 to serve municipalities and local officials, said it does not want cities, towns, and boroughs left with unanticipated or unintended costs.

The league is urging mayors to request their state representatives who support legalization to also support an up to 5 percent tax on marijuana-related revenues for local host communities.

Murphy’s office was said to be unhappy with a draft legalization bill’s proposed 10 percent state tax on retail marijuana businesses, which is the lowest tax among nine states where recreational cannabis is legal.

The original legalization bill included a state tax of 25 percent on marijuana industry gross revenues and it’s likely a compromise will be worked out to increase the state tax rate.

A local option tax

While Murphy’s office looks to up its tax take before a bill’s formal introduction, the league says municipalities are also being shortchanged by a draft bill that only allocates “a local option tax of up to 2 percent to be retained by the host community.”

In response to media coverage reporting a likely 2 percent host community tax, the league reached out to two additional statewide mayors associations and met with state Sen. Nicholas Scutari, prime sponsor of the legalization bill, in August to request a higher local tax on any cannabis-related businesses.

“Based on our discussions with mayors and with our fellow leagues in states that have legalized marijuana, it is our belief that 2 percent is insufficient to offset costs and is an incentive for municipalities to opt out. Enforcement will fall almost entirely on municipal governments, which will need to absorb costs associated with law and code enforcement, health services, education, and social services,” said Michael Cerra, assistant executive director of New Jersey’s league.

While Cerra noted all three organizations representing state mayors are “generally supportive” of medical marijuana and decriminalization, he said mayors “are not prepared to support” marijuana legalization without specific recommendations taken into account in the bill.

He said these include: a local excise tax of up to 5 percent on any of four marijuana-related businesses; a mandate to enter a local host benefit agreement; a mechanism to ensure local reimbursement of tax revenues; and that cannabis businesses are subject to any local fees or licenses. Cerra said a host benefit agreement provides extra services or remuneration to a town.

What’s more, Cerra noted two recommendations for portions of state tax revenues to be dedicated to local law and health enforcement, including funds for training drug recognition experts (DREs) and development of a statewide driving under the influence (DUI) protocol.

“There are issues apparent in any legislation that would legalize the recreational use of marijuana. In particular, it is critical to communicate that the suggested 2 percent option tax is insufficient and should be changed so that municipalities can choose to implement an up to 5 percent fee,” Cerra said.

Opt in or opt out?

As part of its push to increase the local cannabis tax rate up to 5 percent, the League also asked for communities to have to opt in rather than pass an ordinance to opt out if they wish to prohibit local marijuana enterprises.

He said that though that’s the hope, it appeared municipalities would be required to opt out within six months of legalization if they wanted to prohibit any of four proposed cannabis-related enterprises.

Cerra said it was unclear if a legalization bill would “grandfather” ordinances opposing local marijuana retail shops, but he said towns would be wise to opt out by passing an ordinance that includes language excluding all business types in the bill.

The four proposed marijuana business licenses cover growth and cultivation, manufacturing, transportation and distribution, and retail.

It appears unlikely a home-grow option will be included, though the possibility was initially discussed.

‘A dedicated allocation’

Cerra said once hearings begin in the state Senate and Assembly on a legalization bill, the league will focus on “a dedicated allocation in the bill, a fixed annual percentage of the tax revenues to be dedicated to [local] court costs for working through the expungement process for past low-level convictions and development of a DUI protocol for drugged driving.”

“We want sufficient local revenue to offset the [legalization] costs that are state driven. The state will controls that process and the state needs to step up to the plate,” Cerra told Pascack Press Sept. 25.

Mayors not happy

This paper’s canvass of area mayors in the past six months turned up strong opposition to legalization. The officials cited the regional opioid crisis, increasing overdose deaths, and lack of a reliable police roadside test for marijuana impairment.

Many towns passed resolutions and ordinances opposing establishment of any local retail marijuana sales this year, though some allow an exception for medical marijuana.

Strong opposition from mayors and local police chiefs—and their county and state associations —are also based on the belief that marijuana is a “gateway drug” for youth, and amid an ongoing opioid epidemic, legalization of marijuana can only compound youth drug problems and send the “wrong message” on drug use and abuse.

“I have a hard time imagining how all this [legalization] would work and all the ramifications,” said Alpine Mayor Paul Tomasko, president of Bergen County’s League of Municipalities.

He added, “Hopefully, this is something we are not forced to deal with. It’s still a big question mark. The only course of action is to pay attention and weigh in where we have clear understanding of impacts.”

Hillsdale Mayor John Ruocco said marijuana legalization will “have negative consequences to us as a society.”

Ruocco said police officials and school leaders oppose legalization and despite the strong opposition, Murphy and state political leaders are intent on passing the bill.

“This means that the governor is not on the same wavelength as the people on this issue,” Ruocco said.

He agreed that should marijuana be legalized, a host community should get up to 5 percent in tax revenues but noted “personally I’m not in favor of legalizing retail recreational marijuana.”

In June, Woodcliff Lake Mayor Carlos Rendo told Pascack Press that states where cannabis is legal—such as California and Colorado—have seen the drug’s ill effects and less revenue than expected.

“Look, the police are against it, drug counselors are against it, it just opens the door for more drug use. And people loitering around put an extra burden on police and emergency services,” he said.

Medical cannabis growing as more towns ban pot sales

On Nov. 1, the state Department of Health is scheduled to announce six new medical marijuana dispensaries—two in North Jersey, two in Central Jersey, and two in South Jersey. New Jersey has six medical dispensaries to distribute medical marijuana statewide to about 30,000 patients.

The state received 146 applications to run the six new medical dispensaries.

In addition, more than a dozen Bergen County municipalities have banned marijuana sales, including the Township of Washington, Emerson, Westwood (this was just vetoed but the ban is likely to be reinstated; see our story on Page 1), Mahwah, Hasbrouck Heights, Garfield, Carlstadt and Montvale.

Tenafly and Englewood are considering similar action.

Fort Lee is being targeted by potential medical marijuana operators due to its “prime location” for a dispensary, according to recent media reports. Fort Lee, as a gateway community to New Jersey and Bergen County upon crossing the George Washington Bridge from New York City, provides access to approximately 25 state highways, with over 100,000 vehicles passing through daily.

Cerra said he anticipates much opposition and lobbying when legalization bill hearings begin, with advocates and opponents clashing over host community tax revenues, previous low-level marijuana possession expungements, minority participation, and how to allocate annual statewide tax revenues.

[slideshow_deploy id=’899′]