BERGEN COUNTY, N.J.—A Suez legal response asserts that a state ratepayer advocate’s request to throw out its proposed customer lead line replacement program “must be denied” since it has “the wrong set of ‘facts,’ applied the wrong law and reached the wrong conclusion.”

A decision on the conflicting legal motions is expected by late February or early March, said attorneys.

Since Suez proposed a customer lead line replacement pilot program in March 2019, the proposal has been bogged down by legal challenges from a state agency—the Division of Rate Counsel—that represents ratepayers in utility matters statewide.

While Suez owns the service lines from the street main to curb, customers own the lines from the curb into the home or business.

In order to reduce the threat of lead leaching from customer lead service lines, Suez proposed to replace the lines for $1,000, with the balance paid by a surcharge on Suez’s 200,000 customers.

Following evaluation of applicable laws, an Office of Administrative Law judge assigned to the 10-month-old Suez request to undertake a two-year pilot program to replace customer lead lines will hold oral arguments in the case.

The state Division of Rate Counsel must reply to Suez’s response by February 18.

Oral arguments are scheduled Feb. 25, after which the administrative law judge will set a decision date.

A Rate Counsel spokeswoman said “evidentiary hearings” may be scheduled in June for both sides.

Advocate ‘misunderstood’

Suez’s motion filed Feb. 3 with state Office of Administrative Law Judge Jacob S. Gertsman alleged the state Division of Rate Counsel—which opposes the customer program due to Suez’s proposal to increase all customers’ bills—“misunderstood the [Suez] proposal and appears to confuse rates with rate base,” notes the motion.

The filing says Rate Counsel’s argument that Suez wanted to include the pilot program in its rate base is “wholly irrelevant because they address a request the company has not made and that is not now before this court or the [state] Board of Public Utilities,” states the Suez motion.

Suez’s motion said the utility disagreed with Rate Counsel’s argument that adding a surcharge to rate base “is on its face illegal as a matter of public utility law” and alleged Suez “is not requesting rate base treatment for these replacement costs.”

‘Multiple valid approaches’

Instead, Suez argues that “it is well-settled law that there are multiple valid approaches within the (BPU’s) ratemaking authority to accomplish its public policy objectives.”

Suez requests that the BPU “use a traditional regulatory technique (inclusion of a regulatory asset amortized over a limited time) to recover costs which need to be expended to protect and promote the public health.”

Suez previously requested an up to 85 cents monthly surcharge to pay for its pilot program and also proposed a 10 percent mark-up over costs to be included.

‘Response is ‘No’

“Rate Counsel has consistently refused to provide any remedy within the bounds of public utility law and practice to help solve this public health issue. Instead their response is ‘no.’ ‘No’ to any [Suez] program to deal with the non-company-owned lead service lines. ‘No’ to recovery of any dollars spent on non-company owned property, and ‘No’ to any suggestion as to how this public health concern should be addressed or alleviated,” states the Suez filing.

Rate Counsel’s motion to deny Suez’s proposed pilot customer lead pipe replacement effort is based on longstanding utility law that ratepayers can only be charged rates for investments in utility property “that are used and useful in the public service.”

It alleges customer lines are not part of Suez’s “asset base,” and that Suez “cannot recover costs associated with replacing such customer-owned lines from ratepayers.”

‘Status quo…unacceptable’

The Suez motion notes high cost makes customers “reluctant to replace their lead service lines” and notes Rate Counsel’s argument “effectively places the public back at status quo on a public health issue that all can agree is unacceptable.”

The Suez motion notes Suez’s pilot program only asks customers to pay $1,000 to replace a customer line and “expenses the net remaining cost of replacing those lines (initial results indicate about $3,000+ per single family residence—leaving a net of about $2,000 per residence), treats those unamortized costs as a regulatory asset, amortizing those net costs over 7 years, without ever owning or controlling (or putting into rate base) the replacement lead service line.”

It asks that Judge Gertsman “promptly deny Rate Counsel’s motion, so that the public and our customers will know that the [BPU] and [Suez] are working actively to address their lead concerns, and the parties can move forward with the remaining issues to be resolved—either through agreements or litigation.”

Since January 2019, when Suez reported elevated levels of lead in drinking water in 15 of 108 homes sampled during late 2018, the utility initiated a utility lead line replacement effort, later expediting efforts to remove 2,517 lead lines last year and also plans to remove about 2,000 more in 2020.

While recent home lead sampling results have been below the federal 15 parts per billion drinking water standard, the utility continues to replace its lead pipes and lobby for the pilot customer replacement effort it proposed last March.

Health officials stress that lead in drinking water has been known to cause cognitive impairment, especially in children, and chronic high lead levels may lead to irreversible damage and even death.

‘Playing games’

“I think they’re playing games,” said Stefanie Brand, director, Division of Rate Counsel on Feb. 5, asked about Suez’s legal response.

Brand said Suez is “still trying to earn a profit on other people’s property” and that is not allowed by longstanding utility law.

“They’re playing a shell game…they’re trying to use accounting buzzwords to argue that they’re not doing what they’re in fact doing,” said Brand of Suez’s motion.

Brand said in previous discussions to reach a settlement on a customer replacement program, “we haven’t had a willing partner at the table.”

She said Suez has options, including state and federal infrastructure grants, or low-interest loans for customers, to replace customer lead lines.

“They still want to earn a profit on property that is not theirs,” Brand said.

Brand said under law, Suez was entitled to a return of about 9.6 percent, but not for work on private property that they do not own. She also said Suez’s original proposal included an increase to its “rate base” which the utility then changed.

Moreover, Brand said the utility has not disclosed any specifics about the pilot program’s total costs or total number of customers to be targeted.

Public opposition

While a handful of individuals appeared Jan. 21 at a public hearing to oppose the up to 85 cents surcharge on all customer bills—several who testified had already replaced lead lines—Suez officials state that it has found customers will not replace lead lines due to cost and need a monetary incentive.

Generally, Suez has estimated replacement costs between $3,000 to $5,000 per customer lead line replacement, and occasionally up to $8,000.

“Under [Suez’s] proposed pilot program, no part of a replaced non-company side lead service line would be placed into rate base. Instead, it would be expensed and amortized over seven years,” states the Suez legal brief.

‘Fully recover…expenditures’

“Plainly put, the Petition at issue in this proceeding poses the following issue: Can [Suez] fully recover prudent expenditures made to replace non-company side lead service lines for the benefit of the public health as a regulatory asset amortized over seven years? Despite Rate Counsel’s motion, that issue (and numerous others) must still be resolved,” concludes the Suez response.

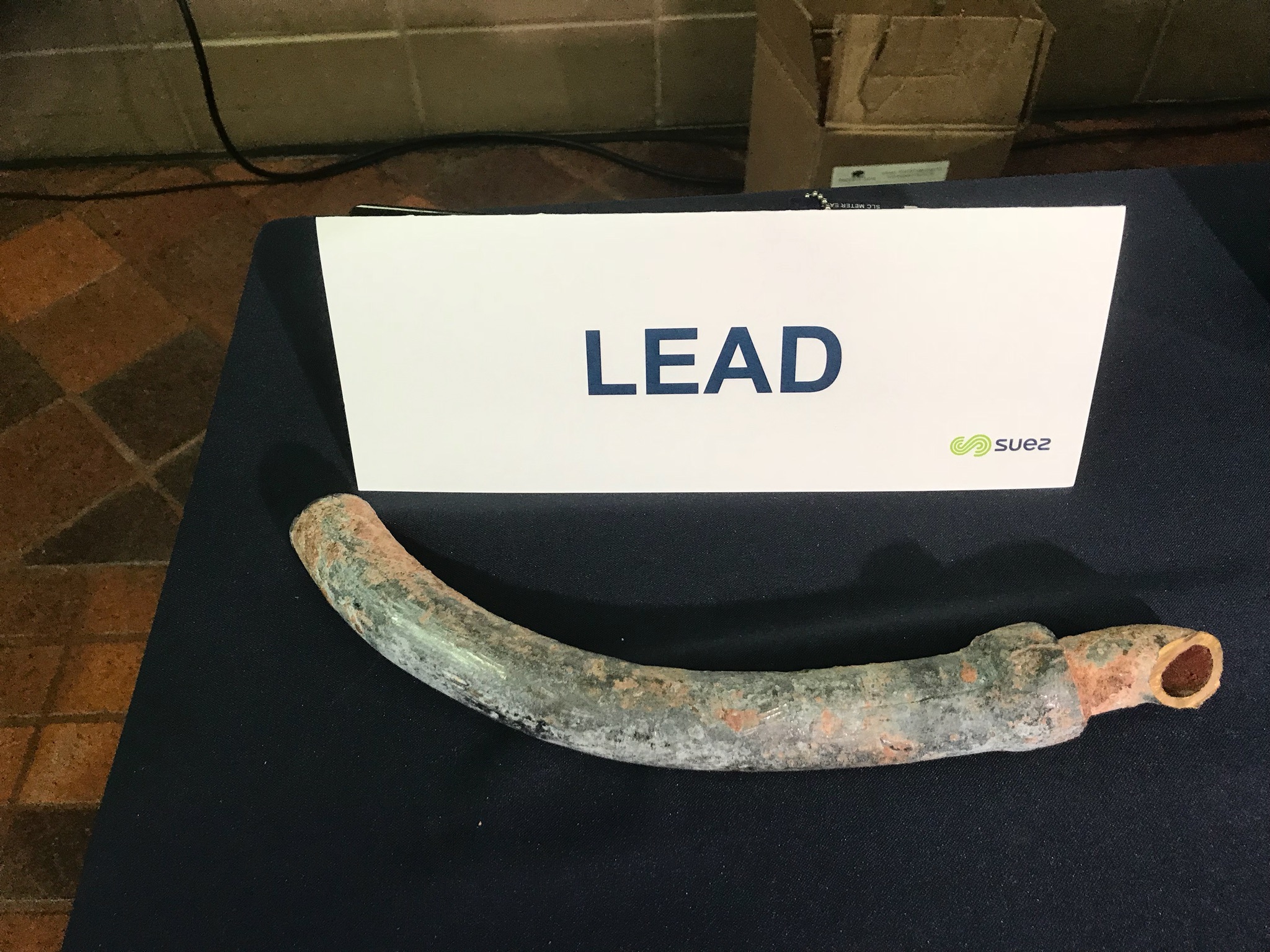

After the Jan. 21 public hearing, Suez spokeswoman Debra Vial said the utility estimates 5,491 known utility lead service lines, 17,248 suspected lead goosenecks, or connectors between mains and customer lines, and 1,469 unknown service lines.

As for customer lines, Suez reported 134,000 with no lead, 4,577 service lines have lead, and 2,087 of those 4,577 lines have lead only on the customer side.

Vial said 68,000 customer lines are currently unknown.

No town-by-town lead data

Suez has declined to release specific information on where remaining utility-owned lead lines exist, or even provide numbers for Suez-owned lead lines in specific towns served by the utility.

Utility officials, including Vial, said Jan. 21 that privacy laws prevent them from providing such data, although a Suez attorney, Stephen Genzer, was not able to cite a law that prohibited release of such data.

Initially, the utility’s replacement efforts focused on priority towns that included high numbers of Suez-owned lead service lines.

Despite repeated requests, Suez has not released numbers of known utility or customer lead lines in the Pascack Valley and Northern Valley towns it serves.

Generally, Vial said, the utility will not replace its lead service line if the customer also does not agree to replace their lead line.

Most replacements have involved the utility replacing its lead line where the customer’s line is not lead.

She said if only one part of a lead line is replaced, the changes in water chemistry frequently cause elevated lead levels on the customer side.

Suez North America, a global private utility, serves 200,000 customers in 57 towns in Bergen and Hudson counties.