BY MICHAEL OLOHAN

OF PASCACK PRESS/NORTHERN VALLEY PRESS

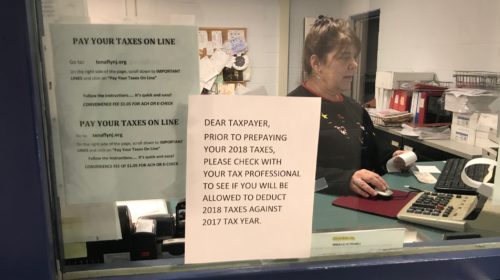

BERGEN COUNTY, N.J. —— Municipal tax collection offices were unusually busy last week as taxpayers rushed in to prepay 2018 property taxes in hopes of beating the new federal tax reform law – effective Jan. 1 – that limits the amount of state and local taxes that can be deducted.

[slideshow_deploy id=’899′]

The federal Tax Cuts and Jobs Act caps – signed Dec. 22 by President Donald Trump – limits the amount of 2018 state and local taxes that can be deducted on federal income taxes to $10,000 annually. The new tax reform law, passed by Republicans without a single Democratic vote, caused local taxpayers to make frantic calls to accountants as well as hurried trips to tax collectors’ offices.

At most local tax offices, the calls streamed in and lines of residents continued throughout the week as worried taxpayers – many paying well over the new $10,000 state and local annual tax deduction limit – felt the pressure of a Dec. 31 deadline to prepay 2018 taxes to claim a deduction on all or part of their 2018 property taxes.

Meanwhile, Gov. Chris Christie signed an executive order Wednesday, Dec. 27, requiring municipalities to credit early 2018 payments that are postmarked by Dec. 31.

That same day, the federal Internal Revenue Service issued a statement that said taxpayers will only be able to take deductions for 2017 if local taxes have already been assessed and billed.

[slideshow_deploy id=’899′]

Tenafly

Taxpayers lined up in Tenafly over the last week and on Thursday, Dec. 28, a line of about 15 residents crowded the hallway leading to the Tax Collector’s window. Most appeared willing to pay at least a portion of 2018’s property taxes in 2017, hoping to retain the maximum federal income tax deduction possible.

Tenafly resident Elizabeth Hieglinian, of Howard Park Drive, said she went in to prepay the first two quarters of 2018 property taxes, and she was asked if she also wanted to prepay the full 2018 tax bill.

She said she prepaid the entire amount. Her 2017 taxes were approximately $15,000, she said.

“We don’t know what’s going to happen. It’s a gamble and you gotta be in it to win it,” she told Northern Valley Press. “It’s really hard to play a game when you don’t know what the rules of the game are,” she said, referring to Gov. Christie’s executive order and the IRS guidance, both issued the day before.

“If you don’t prepay at all you may not be eligible for any extra deductions,” she said, as others around nodded in agreement. “I’m hoping that our politicians will look at providing goods and services here at lesser cost. Why can’t we in New Jersey do that?”

A Buckingham Road taxpayer on line said she was waiting to prepay all 2018 taxes as she was not sure that her mortgage company would do that for her as promised. Her 2017 taxes were $68,000.

Janine McKee, a resident of Oak Avenue for 41 years, said she talked to her accountant and was going to prepay one quarter. She said her 2017 taxes were approximately $15,000. When she first moved to Tenafly, she said her annual taxes were $2,500.

“Things are changing on a daily basis. Nobody seems to understand what is going on with this tax [reform] bill,” said Mayor Peter Rustin. He called the federal tax reform law “ill-conceived and not at all well-thought out” and doubted anyone really read the bill before voting to pass it.

Tenafly Police Lt. Adam Kopesky kept the assembled residents in an orderly line as each waited patiently to prepay 2018 taxes.

Most local tax collectors advised taxpayers hoping to prepay 2018 taxes to go to their municipal offices before posted closing times on Friday. (NOTE: Some offices close early Friday for the New Year’s weekend.)

If getting to a local tax collection office is not possible, officials said to make sure that their prepayment check is mailed in an envelope postmarked by Dec. 31, as allowed by Christie’s executive order.

However, most U.S. Postal Service offices are closed Sundays, which effectively means Saturday, Dec. 30, is the last day to postmark an envelope with a 2018 tax prepayment check.

Alpine

In Alpine, Tax Collector Marilyn Hayward said that the last week of 2017 “has been busy” with “many people prepaying more than usual.” She said the borough was accepting full 2018 tax year prepayments. “It’s an estimate and we don’t know what the deductions will be,” she added.

[slideshow_deploy id=’899′]

Old Tappan

“Our phones are ringing off the hook,” said Old Tappan Tax Collector Rebecca Overgaard Dec. 28. She said she would not be surprised if nearly $2 million in prepaid 2018 taxes were collected by 4 p.m. Friday.

“We normally do not accept a postmarked payment but this is different from our normal (tax collection) practice,” she said.

“If you want to pay a full year, we’re not advising you what to do. That’s up to you,” she said. She said the average $826,000 borough home paid annual taxes of approximately $16,500.

Hillsdale

Tax Collector Dawn Wheeler sent an email blast Dec. 27 to answer the questions she and staff were getting over and over from phone calls. She said with Christie’s executive order and new IRS guidance on what is deductible, she considered sending another updated email.

“We took in over a million dollars in the last couple of days,” said Wheeler Dec. 28. She said small lines had formed to prepay taxes recently but no long lines as had occurred in other towns.

“We’re just trying to figure this out too,” she said, referring to Gov. Christie and the IRS.

In her letter to residents, Wheeler’s email said all prepayments “must be in the Tax Collector’s office by NOON on Friday (Dec. 29) in order to be posted in 2017. No exceptions.”

She declined offering advice on prepaying taxes.

“Consult your tax preparer or accountant for advice on whether or not to prepay 2018 taxes and if so, what amount will be beneficial to you. The Tax Collector cannot advise you regarding your federal taxes,” she wrote.

In addition, Wheeler said “prepayments are not refundable” and if a taxpayer has a mortgage company paying their taxes, “you must contact them immediately and tell them how much you have prepaid so that they don’t make duplicate payments.”

[slideshow_deploy id=’899′]

Northvale

“It’s insane, normally I collect $80,000 at most in prepaid taxes,” said Tax Collector Suzanne Burroughs. She said if 2018 tax prepayments keep coming, she might top $400,000 in the last week or so.

“I tell people to talk to your accountant. You have the (estimated) tax bills for the first two (2018) quarters. So people will take that figure and double it. Mostly people coming are trying to pay off all of 2018,” she said.

Burroughs said she had heard other tax collectors say that some folks were trying to pay off 2019 tax bills too, but not in Northvale.

“My fear is that the people who have paid more than the first half and the IRS rejects it, they’re going to be upset,” said Burroughs.

“I will take what you give me but I’m not telling you what to do,” noted Burroughs.

She said the passage of new federal tax reform, the governor’s executive order and IRS prepayment statement at year-end created an “unusual situation” for tax collectors and a rush among taxpayers to get in prepayments before Dec. 31.

“It’s going to be something when all the smoke clears on this,” she added.

Burroughs said an average borough home assessed at $390,914 pays approximately $10,695 in annual taxes.

[slideshow_deploy id=’899′]

Montvale

In his Dec. 27 email update headlined “Taxes – Should you pay more in 2017,” Mayor Mike Ghassali wrote that taxpayers “are permitted to prepay 2018 taxes” and payment was due before noon, Dec. 29.

“At this point, only first and second quarter 2018 tax amount are known but if you would like, you may add an additional $500.00 to that amount to approximate the total for 2018. Any remaining balance would be reflected on the new bill … Otherwise, please consult with your tax preparer for more information,” he emailed.

Calls to tax collectors in Tenafly, River Vale, Montvale, Englewood, Closter, and Norwood were not returned before press time.

Photos by Michael Olohan